Car insurance can be confusing and overwhelming, but it's essential to protect yourself and your vehicle while on the road. With so many options and rates available, it can be challenging to choose the right policy for you.

Factors that Affect Car Insurance Rates

Several factors can influence your car insurance rates, including your driving history, age, location, vehicle make and model, and credit score. The more high-risk factors you have, the higher your premiums will be. Some of the most common high-risk factors include:

- Speeding tickets and other moving violations

- At-fault accidents

- DUI or other driving-related convictions

- Young age or lack of driving experience

- Living in a high-crime area

- Driving a sports car or other high-performance vehicle

- Poor credit score

While you can't change some of these factors, you can take steps to lower your premiums. For example, installing anti-theft devices, driving a safer car, and maintaining a good credit score can all help reduce your rates.

Top Car Insurance Policy Exclusions to Look Out For

While car insurance policies can provide comprehensive coverage, some exclusions may surprise you. Before choosing a policy, it's important to know what risks you are and aren't covered for. Some of the most common exclusions to look out for include:

- Loss or damage due to a war or nuclear explosion

- Damage caused by normal wear and tear or mechanical failures

- Intentional damage to your vehicle

- Accidents caused by an unlicensed or uninsured driver

- Driving under the influence of drugs or alcohol

Make sure to read your policy carefully and ask any questions you may have about coverage exclusions. It's better to know ahead of time what risks you may face than to be left without coverage when an accident occurs.

Why Invest in Car Insurance Rate Comparison Websites?

One of the best ways to find the right car insurance policy for you is to compare rates from multiple providers. However, doing so can be time-consuming and overwhelming. That's where car insurance rate comparison websites come in. These sites allow you to enter your information once and get quotes from multiple insurers, making it easy to find the right policy at the right price.

All You Need to Know About Compare Auto Insurance Rates by Vehicle

When comparing car insurance rates, one essential factor to consider is your vehicle. Each make and model has a different safety record, repair costs, and theft rates, all of which can affect your premiums. Some of the most important factors to consider when comparing auto insurance rates by vehicle include:

- The make and model of your car

- The age and mileage of your vehicle

- The safety rating and crash test results of your vehicle

- The cost of repairs and replacement parts for your car

- The likelihood of your car being stolen or broken into

By comparing rates based on your vehicle, you can get a better idea of what you can expect to pay for coverage and make an informed decision about which policy is right for you.

How to Save Money on Car Insurance

While car insurance is necessary, it doesn't have to break the bank. There are several ways to save money on your premiums, including:

- Compare rates from multiple providers to find the best deal

- Increase your deductible to lower your premiums

- Take advantage of discounts for safe driving, multi-car policies, and more

- Bundle your auto insurance with other policies, such as homeowners or renters insurance

- Pay your premiums annually rather than monthly to avoid additional fees

By taking these steps, you can lower your premiums and get the coverage you need at a price you can afford.

Conclusion

Car insurance is an essential part of owning and driving a vehicle, but it can be confusing and overwhelming. By understanding the factors that influence your rates, knowing what exclusions to look out for, and using car insurance rate comparison websites, you can find the right policy for your needs and budget. Plus, by taking steps to lower your premiums, you can save money without sacrificing coverage.

Why should you invest in Car Insurance Rate Comparison Websites?

Investing in car insurance rate comparison websites can save you time and money by allowing you to compare rates from multiple providers at once. Rather than spending hours calling different insurers or visiting their websites, these comparison tools make it easy to get quotes and find the right policy for you.

Factors that Affect Car Insurance Rates

Several factors can influence your car insurance rates, including your driving history, age, location, vehicle make and model, and credit score. By understanding these factors and taking steps to mitigate high-risk factors, you can lower your premiums and get the coverage you need at a price you can afford.

Top 5 Car Insurance Policy Exclusions to Look Out For

While car insurance policies can provide comprehensive coverage, it's important to be aware of any exclusions that may apply. Some of the most common exclusions to look out for include loss or damage due to war or nuclear explosion, intentional damage to your vehicle, and accidents caused by an unlicensed or uninsured driver. By knowing what risks you may not be covered for, you can choose a policy that suits your needs and budget.

Why should you invest in Car Insurance Rate Comparison Websites?

Using car insurance rate comparison websites can save you time and money by allowing you to compare rates from multiple providers at once. Rather than spending hours calling insurers or visiting their websites, comparison tools make it easy to get quotes and find the right policy for you.

All You Need to Know About Compare Auto Insurance Rates by Vehicle

Comparing car insurance rates based on your vehicle can help you make an informed decision about coverage. Factors such as safety ratings, repair costs, and theft rates can all impact your premiums. By using comparison tools that take these factors into account, you can find the right policy for your needs and budget.

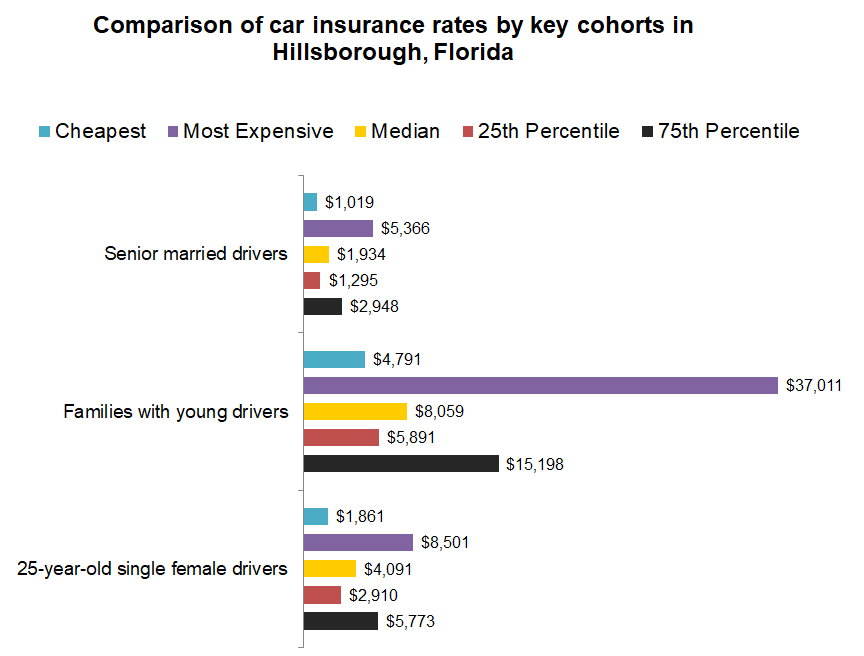

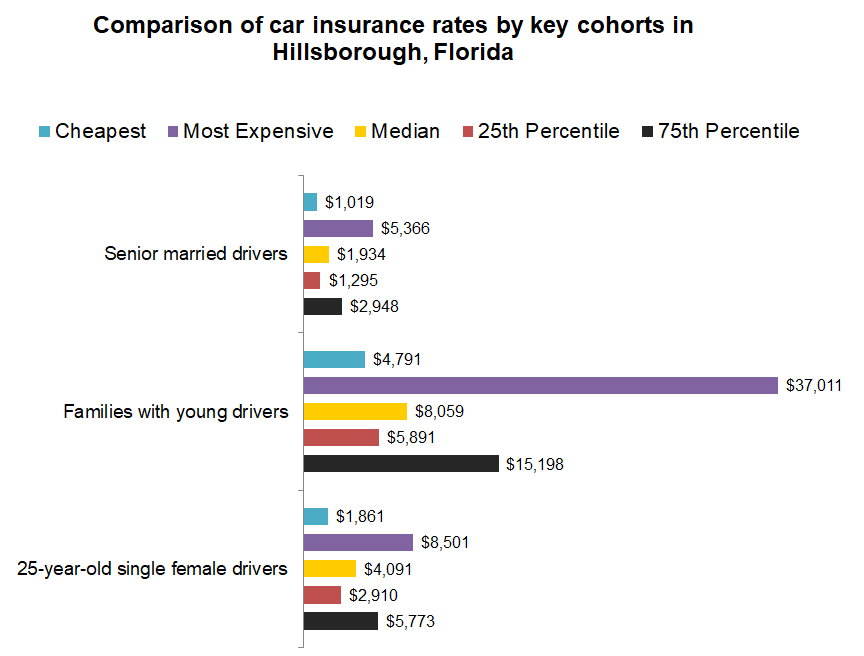

How Do I Save Money on Car Insurance in Tampa, FL?

There are several ways to save money on car insurance in Tampa, FL, including comparing rates from multiple providers, increasing your deductible, and taking advantage of discounts for safe driving and other factors. By bundling your policies or paying annually, you can also avoid additional fees and save even more on your premiums.

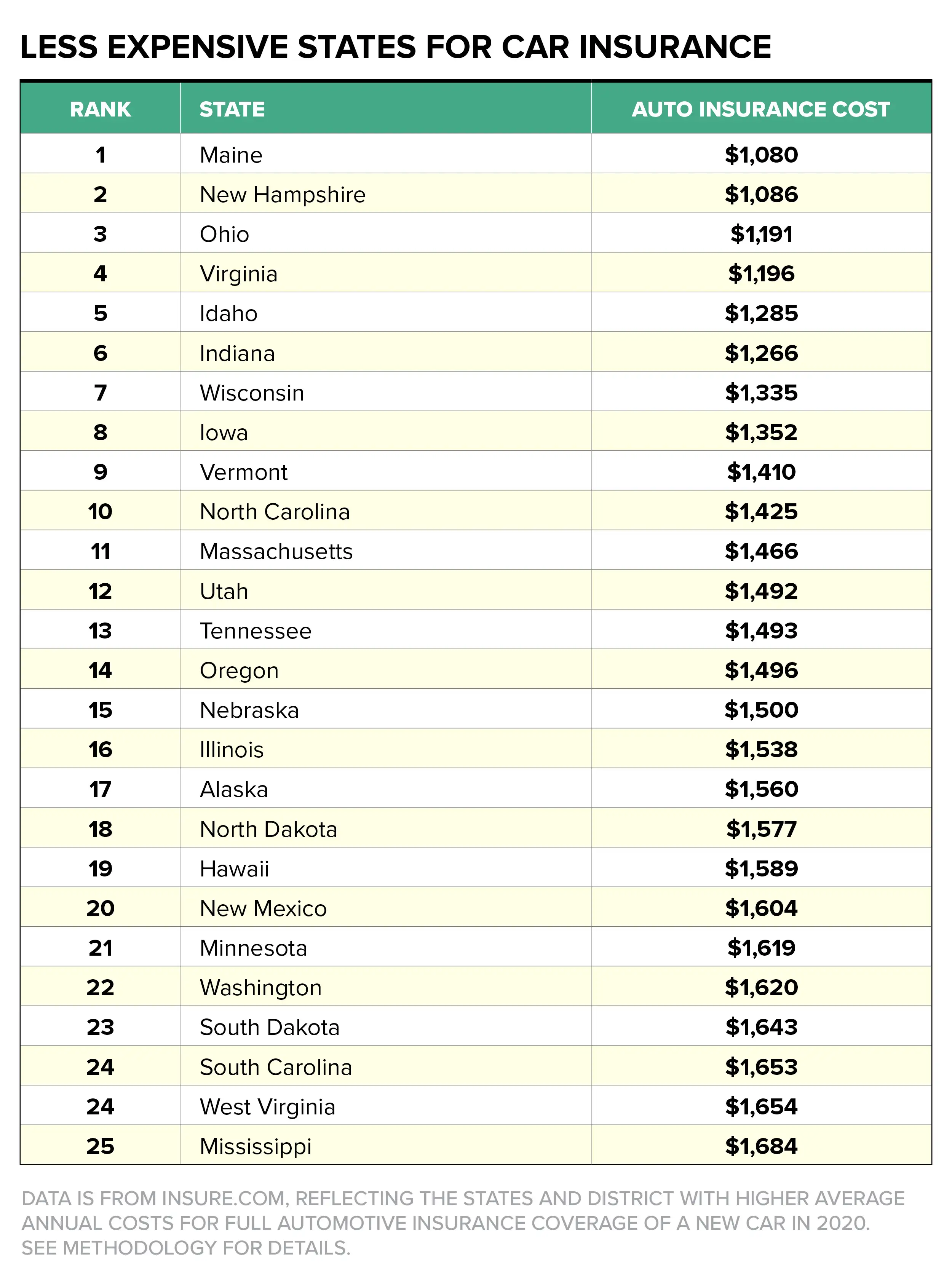

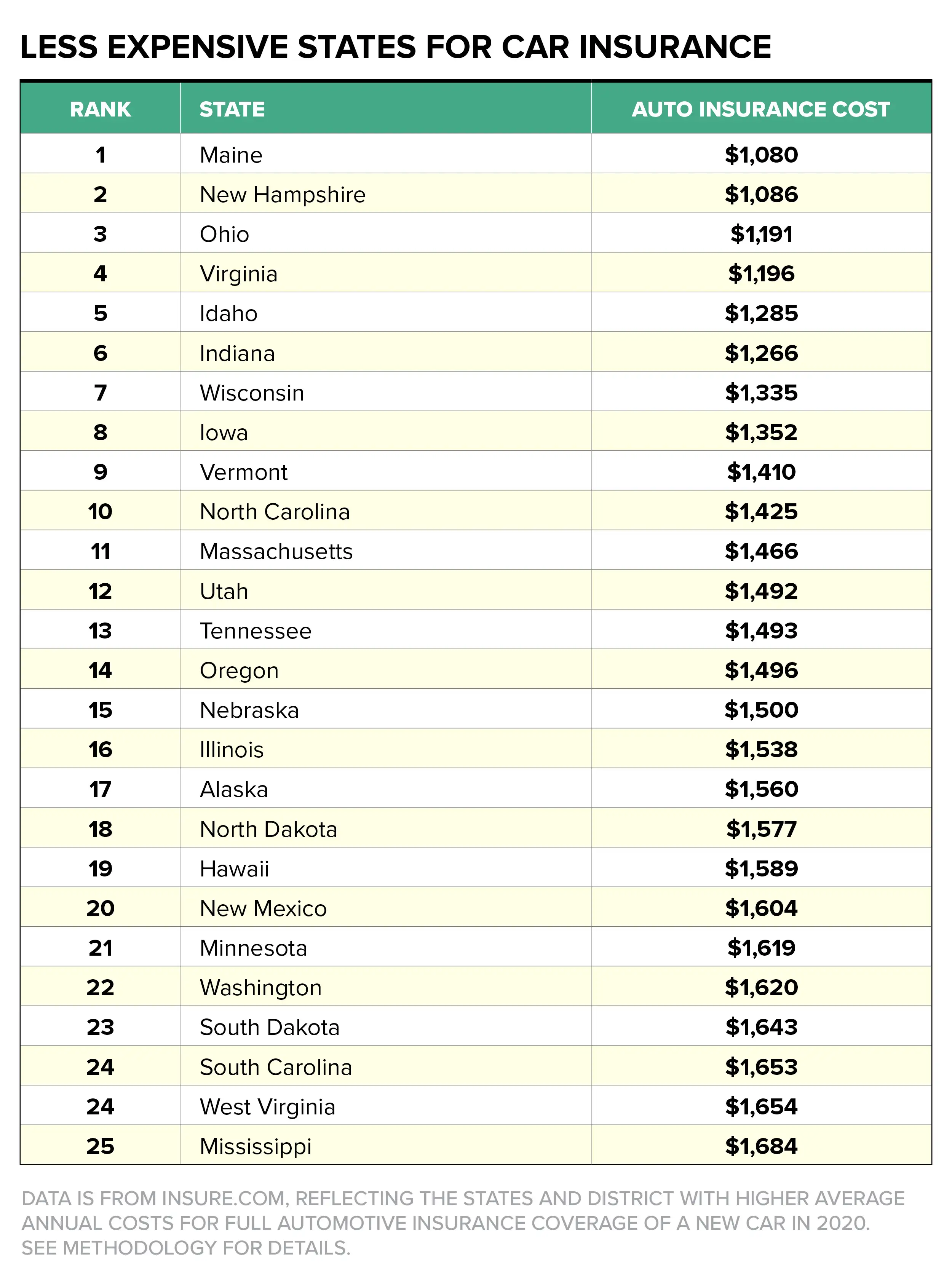

Car Insurance Costs by State

The cost of car insurance can vary widely from state to state, depending on factors such as population density, crime rates, and weather conditions. By comparing rates by state, you can get a better idea of what you can expect to pay for coverage and choose a policy that meets your needs and budget.

Car Insurance Compare Rates

Comparing car insurance rates can be time-consuming and overwhelming, but it's worth it to ensure that you get the coverage you need at a price you can afford. By using car insurance rate comparison websites, comparing rates by vehicle, and taking advantage of discounts, you can save money on your premiums and protect yourself and your vehicle while on the road.

If you are looking for Why should you invest in Car Insurance Rate Comparison Websites? - APK you've visit to the right place. We have 8 Pictures about Why should you invest in Car Insurance Rate Comparison Websites? - APK like Car Insurance Costs by State | Money, Why should you invest in Car Insurance Rate Comparison Websites? - APK and also How Do I Save Money on Car Insurance in Tampa, FL? | Star Nsurance Tampa. Here you go:

Why Should You Invest In Car Insurance Rate Comparison Websites? - APK

apkhumble.com

apkhumble.com insurance invest

Car Insurance Compare Rates - Security Guards Companies

insurance car compare rates comparison auto security

All You Need To Know About Compare Auto Insurance Rates By Vehicle

www.pinterest.com

www.pinterest.com equity compare

Top 5 Car Insurance Policy Exclusions To Look Out For

kwiksure.sg

kwiksure.sg insurance car comparison levels exclusions policy table look benefits singapore each different

Why Should You Invest In Car Insurance Rate Comparison Websites? - APK

apkhumble.com

apkhumble.com websites brokers

How Do I Save Money On Car Insurance In Tampa, FL? | Star Nsurance Tampa

starnsurancetampa.com

starnsurancetampa.com insurance car fl tampa money rate chart

Factors That Affect Car Insurance Rates | FindBestQuote

findbestquote.com

findbestquote.com Car Insurance Costs By State | Money

money.com

money.com insurance auto car state money states rates rate

Insurance invest. Factors that affect car insurance rates. Equity compare

0 Response to "Looking For Car Insurance Rate Comparison All You Need To Know About Compare Auto Insurance Rates By Vehicle"

Post a Comment