As a responsible car owner, it's important to make sure that you have adequate insurance coverage for your vehicle. However, with so many factors to consider, it can be overwhelming to know where to start. That's why we've compiled some useful data on car insurance rates to help you make informed decisions about your coverage.

Comparing Car Insurance Rates by State

One of the biggest factors that can impact your car insurance rates is where you live. As you can see from the chart above, rates can vary significantly depending on which state you reside in. For example, Michigan has the highest average rates in the country, while Maine has the lowest.

The Impact of Teen Drivers on Car Insurance Rates

If you have a teen driver in your household, you may be bracing yourself for higher insurance costs. And unfortunately, the data bears this out. As you can see from the chart above, adding a teen driver to your policy can almost double your rates. However, it's important to make sure that your teen is listed on your policy to ensure that they're covered in the event of an accident.

Age and Car Insurance Rates

Age is another big factor that can impact your car insurance rates. As you can see from the chart above, rates tend to be highest for young drivers, and gradually decrease as you get older. However, rates can start to increase again once you hit your senior years.

Auto Insurance Rate Increases in Pennsylvania

If you live in Pennsylvania, you may be feeling frustrated by the recent increases in auto insurance rates. As you can see from the chart above, rates have gone up by a staggering 22% since 2011. This is due in part to the increasing costs of medical expenses and car repairs, which are reflected in insurance premiums.

Why Auto Insurance Rates Are So High in Ontario

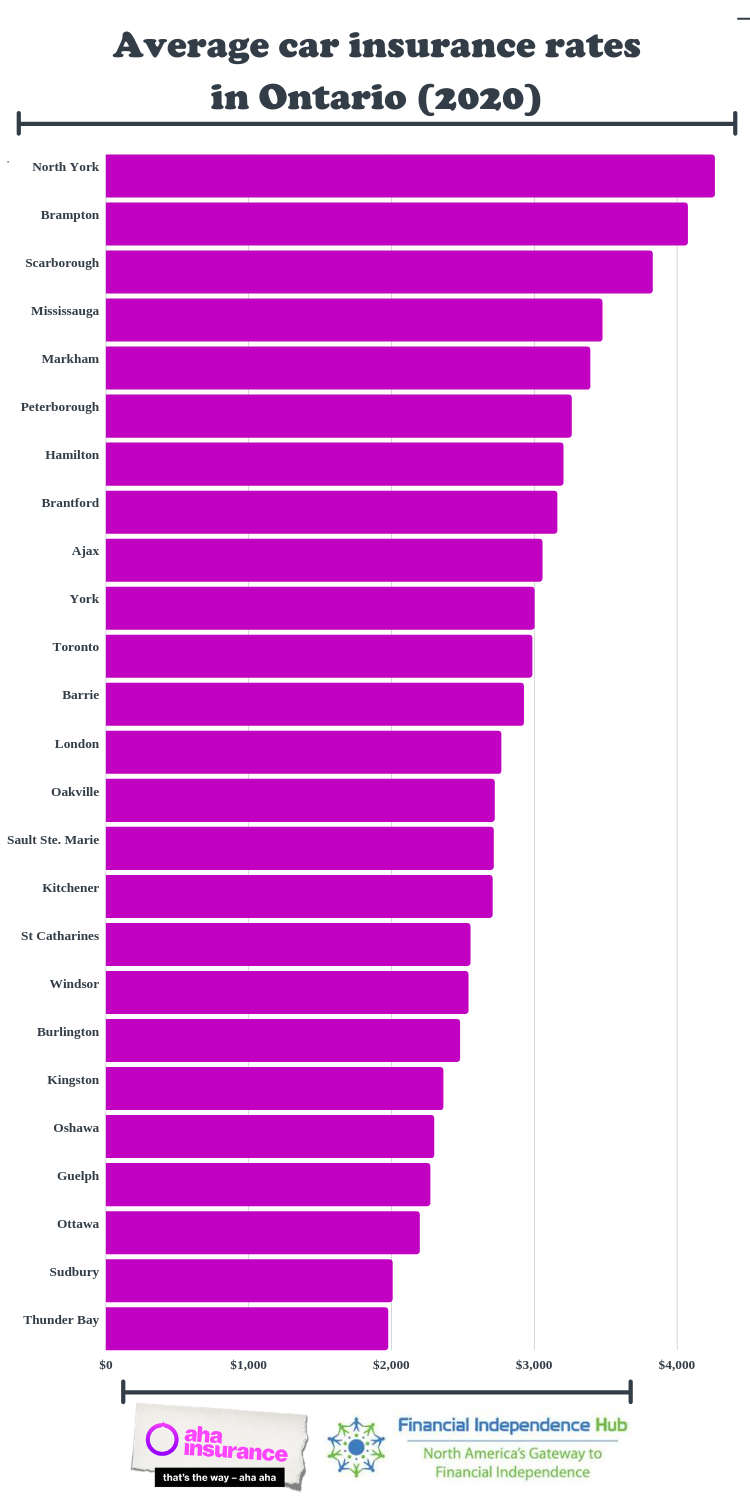

If you live in Ontario, you may be wondering why insurance rates are so high in this province. There are a number of factors that contribute to this, such as the high risk of collisions due to weather conditions and congested traffic, as well as the high cost of repairs and medical expenses.

Ontario Auto Insurance Rates Likely to Increase in 2020

Unfortunately, it looks like Ontario drivers may be in for even more bad news when it comes to auto insurance rates. As you can see from the chart above, rates have been steadily increasing over the past few years, and are expected to go up even further in 2020. That's why it's more important than ever to shop around for the best rates and coverage options.

Provinces in Canada Paying the Most Car Insurance Rates and Why

Finally, if you're a Canadian driver, you may be interested in knowing which provinces pay the most for car insurance. As you can see from the chart above, Ontario has the highest average rates, followed closely by British Columbia and Alberta. The factors that contribute to higher rates in these provinces include high population density, severe weather conditions, and high levels of car theft and fraud.

Conclusion

As you can see from the data above, there are many factors that can impact your car insurance rates. However, by taking the time to understand these factors and shop around for the best coverage options, you can ensure that you're getting the best value for your money. Remember, the cheapest policy isn't always the best policy, so make sure that you're getting the coverage you need to protect yourself and your vehicle.

If you are searching about Average Car Insurance By State / Minnesota Auto Insurance Made Easy you've came to the right web. We have 8 Images about Average Car Insurance By State / Minnesota Auto Insurance Made Easy like Compare Car Insurance : Teen Drivers Nearly Double Car Insurance, Average Car Insurance By State / Minnesota Auto Insurance Made Easy and also New data shows location has a big impact on car insurance - Financial. Here it is:

Average Car Insurance By State / Minnesota Auto Insurance Made Easy

entretriperos.blogspot.com

entretriperos.blogspot.com coverage businessinsider premiums

Compare Car IIsurance: Average Car Insurance Rates By State

dcomparecarinsuran.blogspot.com

dcomparecarinsuran.blogspot.com car insurance rates average state compare name

New Data Shows Location Has A Big Impact On Car Insurance - Financial

findependencehub.com

findependencehub.com insurance

Ontario Auto Insurance Rates Likely To Increase In 2020

www.insurancehotline.com

www.insurancehotline.com insurance rates ontario auto years increase rising rate rise driving chart

Provinces In Canada Paying The Most Car Insurance Rates And Why

mvpns.ca

mvpns.ca insurance auto cheap car rates worth

Shop Insurance Canada Explains Why Auto Insurance Rates Are So High In

insurance ontario auto rates average toronto car rate cost canada cities chart greater canadian why so high 2393 2071 brampton

Auto Insurance Rate Increases In Pennsylvania: Up 22% Since 2011

increases hikes valuepenguin

Compare Car Insurance : Teen Drivers Nearly Double Car Insurance

dailynews.kimama-news.com

dailynews.kimama-news.com Average car insurance by state / minnesota auto insurance made easy. Insurance rates ontario auto years increase rising rate rise driving chart. Increases hikes valuepenguin

0 Response to "Car Insurance Rates Comparison Ontario Auto Insurance Rate Increases In Pennsylvania: Up 22% Since 2011"

Post a Comment