Driving a car gives us the freedom to explore the world and go on exciting adventures. However, with this freedom comes responsibility. One of the most important aspects of being a responsible driver is having car insurance. You never know when an accident might happen and having insurance will help protect you financially. In this post, we will be discussing the cost of car insurance in Jamaica and the USA.

Cost of Car Insurance in Jamaica

Many people in Jamaica are not aware of the cost of car insurance and how it is calculated. There are several factors that determine the cost of car insurance in Jamaica, such as:

- Age

- Gender

- Type of car

- Driving experience

- Driving record

According to a recent study, the average cost of car insurance in Jamaica is approximately JMD 20,000 per year. However, this can vary based on the factors mentioned above.

It is also important to note that car insurance in Jamaica is mandatory. It is illegal to drive a car in Jamaica without having insurance. This is to ensure that all drivers are financially responsible in the event of an accident.

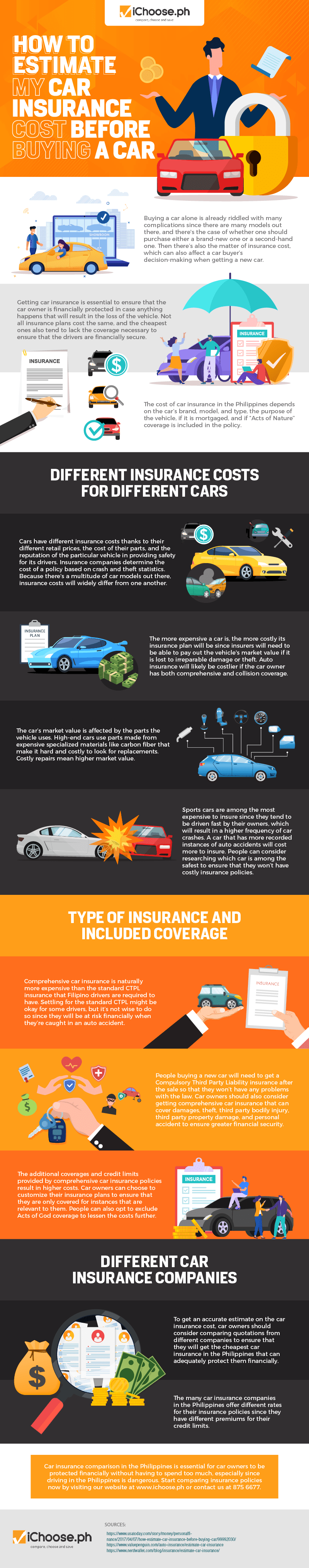

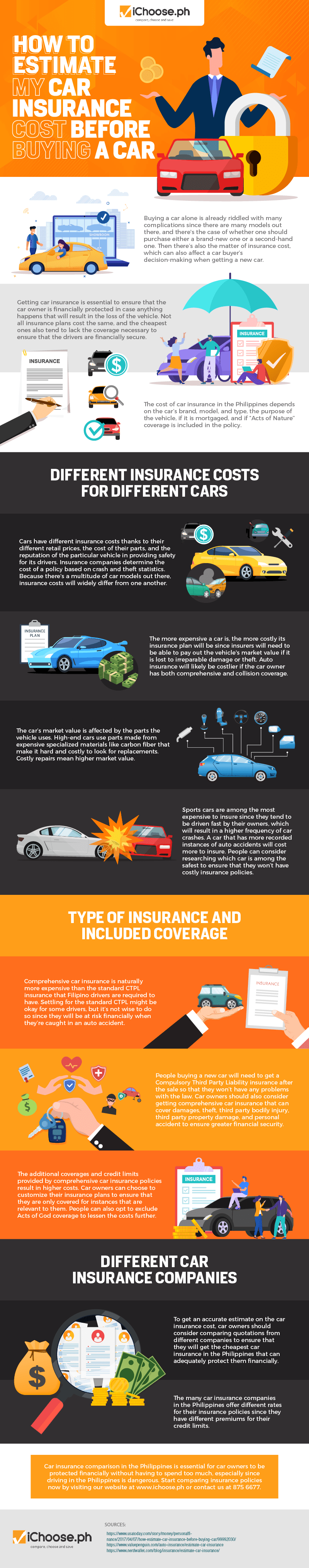

How to Estimate Car Insurance Costs in Jamaica

Before purchasing car insurance in Jamaica, it is important to estimate how much it will cost. This will help you determine how much you can afford and which insurance provider to choose. To estimate the cost of car insurance in Jamaica, you should consider the following:

- Your driving record

- The type of car you own

- The age of your car

- The amount of coverage you need

Once you have considered these factors, you can use an online car insurance calculator to get an estimate of how much it will cost. This will give you a rough idea of how much you will need to budget for car insurance in Jamaica.

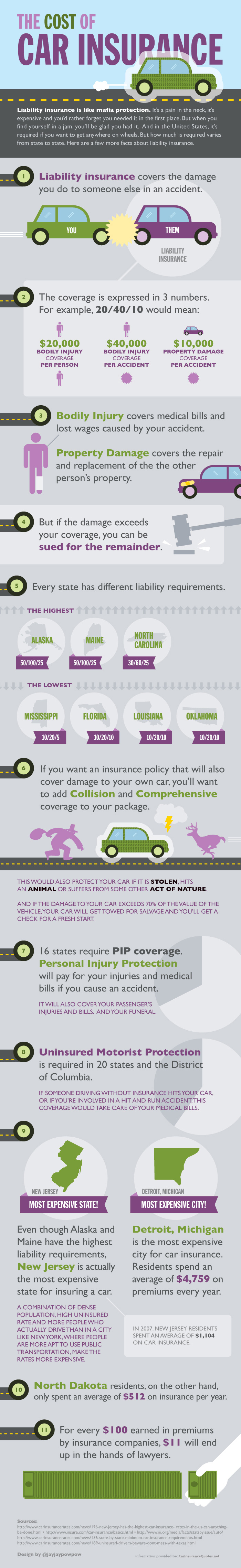

Cost of Car Insurance in the USA

The cost of car insurance in the USA varies greatly depending on where you live, the type of car you own, and your driving record. According to a recent study, the average cost of car insurance in the USA is approximately $1,502 per year.

However, there are several factors that can impact the cost of car insurance in the USA. These include:

- Your age and gender

- The type of car you own

- Your driving record

- Your credit score

- The amount of coverage you need

- Your location

The cost of car insurance can be higher in certain areas of the USA. For example, if you live in a city with a high crime rate or high traffic volume, you may have to pay more for car insurance. On the other hand, if you live in a rural area with fewer cars on the road, your car insurance may be less expensive.

How to Get the Best Car Insurance Rate in the USA

If you are looking to get the best car insurance rate in the USA, there are several things you can do. Here are some tips:

- Shop around: Get quotes from multiple insurance providers to compare rates.

- Bundle policies: If you have other types of insurance (such as home or life insurance), bundle them with your car insurance to get a discount.

- Drive safely: A clean driving record can lower your car insurance rate.

- Consider a higher deductible: A higher deductible means you will pay more out of pocket if you get into an accident, but it can lower your monthly car insurance payments.

- Improve your credit score: A higher credit score can lead to lower car insurance rates.

Conclusion

Whether you live in Jamaica or the USA, car insurance is an important aspect of being a responsible driver. The cost of car insurance can vary greatly depending on several factors. It is important to estimate how much car insurance will cost before purchasing it. This can help you choose an insurance provider that fits your budget and ensure that you are financially protected in the event of an accident.

Remember, the cost of car insurance is not the only factor to consider. You should also consider the amount of coverage you need and the reputation of the insurance provider. By doing your research and following these tips, you can get the best car insurance rate and drive with peace of mind.

References

- Value Penguin - Average Cost of Insurance

- RAELST - How Much Does Car Insurance Cost in Jamaica

- Coverfox - Car Insurance in Jamaica

- Insure Me SGB - Cost of Car Insurance and Why

- Car and Driver - Car Insurance Tips

If you are searching about Cost Of Car Insurance And Why | Murrieta | Insure Me SGB you've visit to the right place. We have 8 Images about Cost Of Car Insurance And Why | Murrieta | Insure Me SGB like How to Estimate My Car Insurance Cost Before Buying a Car - Digital Blogs, How Much Does Car Insurance Cost In Jamaica - RAELST and also How Much Does Car Insurance Cost In Jamaica - RAELST. Here it is:

Cost Of Car Insurance And Why | Murrieta | Insure Me SGB

insuremesgb.com

insuremesgb.com Cheapest Auto Insurance Rates In The US - Infographics Charts Quotes

gordcollins.com

gordcollins.com insurance car cost infographic auto visual ly vehicle if quotes cheap cheapest rates required fifty health states while infographics life

How To Estimate My Car Insurance Cost Before Buying A Car - Digital Blogs

inpeaks.com

inpeaks.com ichoose ph

How Much Does Car Insurance Cost In Jamaica - RAELST

raelst.blogspot.com

raelst.blogspot.com jamaica

How Much Does Car Insurance Cost In Jamaica - RAELST

raelst.blogspot.com

raelst.blogspot.com How Much Does Car Insurance Cost In Jamaica - RAELST

raelst.blogspot.com

raelst.blogspot.com calculator jamai

How Much Does Car Insurance Cost In Jamaica - RAELST

raelst.blogspot.com

raelst.blogspot.com jamaica mandeville chancellor does addictive companies

Car Insurance Cost In Boston, MA (2022 Cheapest To Insure)

insuraviz.com

insuraviz.com insure cheapest

How to estimate my car insurance cost before buying a car. Cost of car insurance and why. Insure cheapest

0 Response to "Car Insurance Cost In Jamaica How Much Does Car Insurance Cost In Jamaica"

Post a Comment